Our Corporate Advisory practice is led by senior bankers who have advised marquee clients across a wide range of industries. We offer bespoke advisory solutions to corporates seeking support for equity capital raise, M&A, and valuations. We act as trusted independent advisors to our clients and combine sector expertise and sharp execution to deliver successful outcomes.

We have the capabilities to address special situations and client needs as a firm leveraging our extensive experience to provide optimal solutions. For our clients, the corporate advisory team at NRC has delivered multiple successful transactions in India and in the Indo-US corridor across multiple sectors.

Clients rely on us to help unlock value in their business and turn their longer-term goals to reality. Our entrepreneurial approach and owner driven mindset allows us to be unbiased, independent and professional while still being cognizant of the sensitivities that founders and management teams carry for their business.

We offer big firm capabilities with a boutique firm feel where relationships score over transactional opportunism.

Boutique, Nimble, & Relentlessly Client Focused

Our Corporate Advisory practice is led by senior bankers who have advised marquee clients across a wide range of industries. We offer bespoke advisory solutions to corporates seeking support for equity capital raise, M&A, and valuations. We act as trusted independent advisors to our clients and combine sector expertise and sharp execution to deliver successful outcomes.

We have the capabilities to address special situations and client needs as a firm leveraging our extensive experience to provide optimal solutions. For our clients, the corporate advisory team at NRC has delivered multiple successful transactions in India and in the Indo-US corridor across multiple sectors.

Clients rely on us to help unlock value in their business and turn their longer-term goals to reality. Our entrepreneurial approach and owner driven mindset allows us to be unbiased, independent and professional while still being cognizant of the sensitivities that founders and management teams carry for their business.

We offer big firm capabilities with a boutique firm feel where relationships score over transactional opportunism.

Boutique, Nimble, & Relentlessly Client Focused

Private Capital Raise

With India increasingly becoming a favored destination for global private capital, we look to work with accomplished entrepreneurs and management teams who wish to rapidly scale up their business and help them find the right investment partners who share their vision. We also help assist private equity funds exit their investments through secondaries or via trade sales.

Mergers & Acquisitions

Pursuing inorganic growth through acquisitions and unlocking value through divestitures have become inherent in the corporate world. We represent clients on buy or sell side to help them pursue their M&A plans. M&A deal making exercise is as much an art as science and, over the years, we have mastered the art of executing complex transactions in M&A situations.

Valuation Advisory

The need to establish a strong business case to support fair valuation is key for all stakeholders involved in a transaction and we are able to leverage our multi-disciplinary exposure of various industries and transaction types to provide superior valuation advice backed by fairness opinion, including for accounting and regulatory compliances.

Technology

Consumer Internet, B2B Technology, Frontier Technologies, IT Services & BPO, Digital Transformation & Cloud

Click for track record

Consumer

Consumer Brands, Products & Services, Logistics, Media, Education

Click for track record

Healthcare

Healthcare delivery, Pharmaceuticals, Medical Devices, Health-tech, Veterinary Services

Click for track record

Industrial

Auto Ancillary, Engineering Goods, Industrial Automation, Industrial Ancillaries, Specialty Chemicals

Click for track record

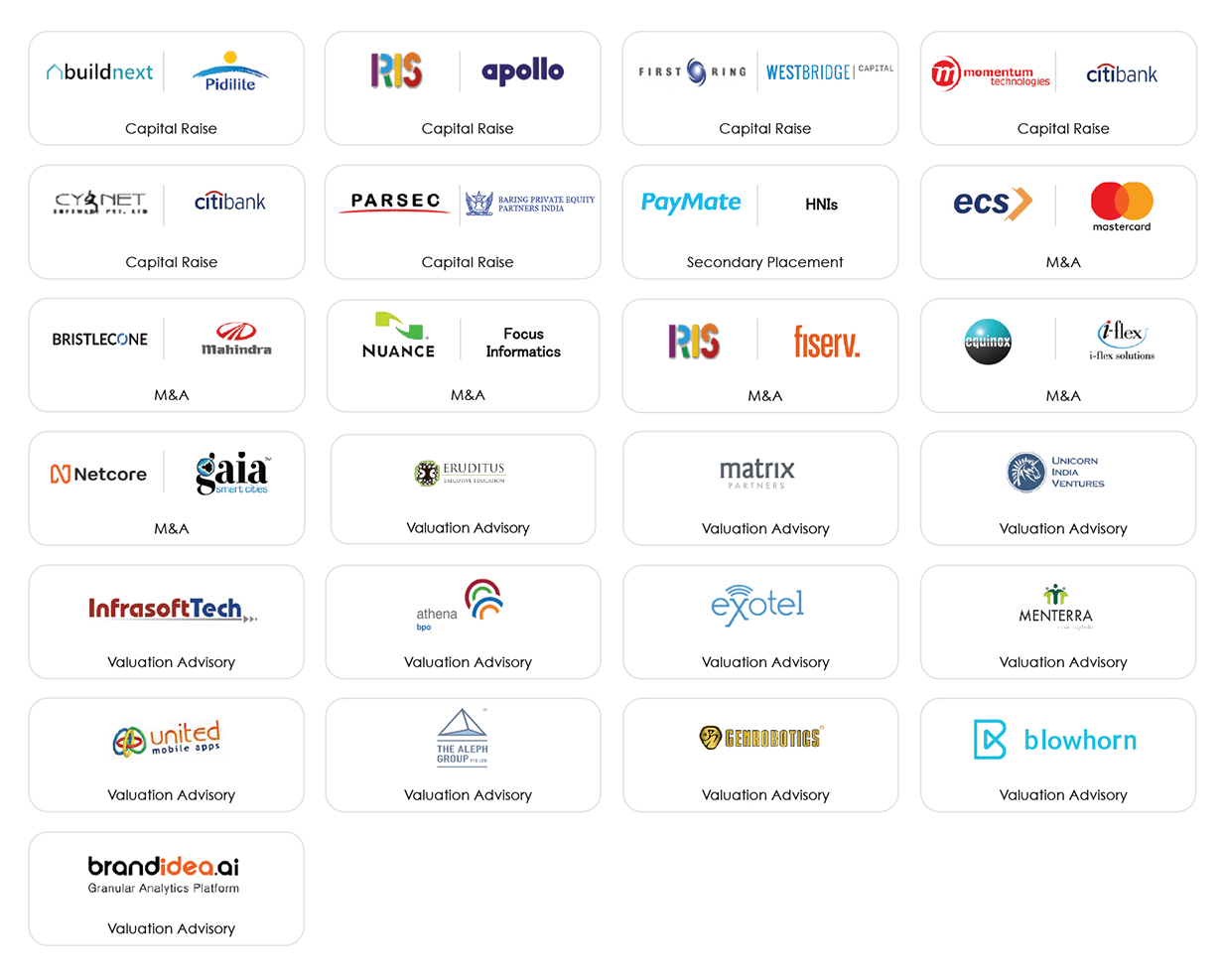

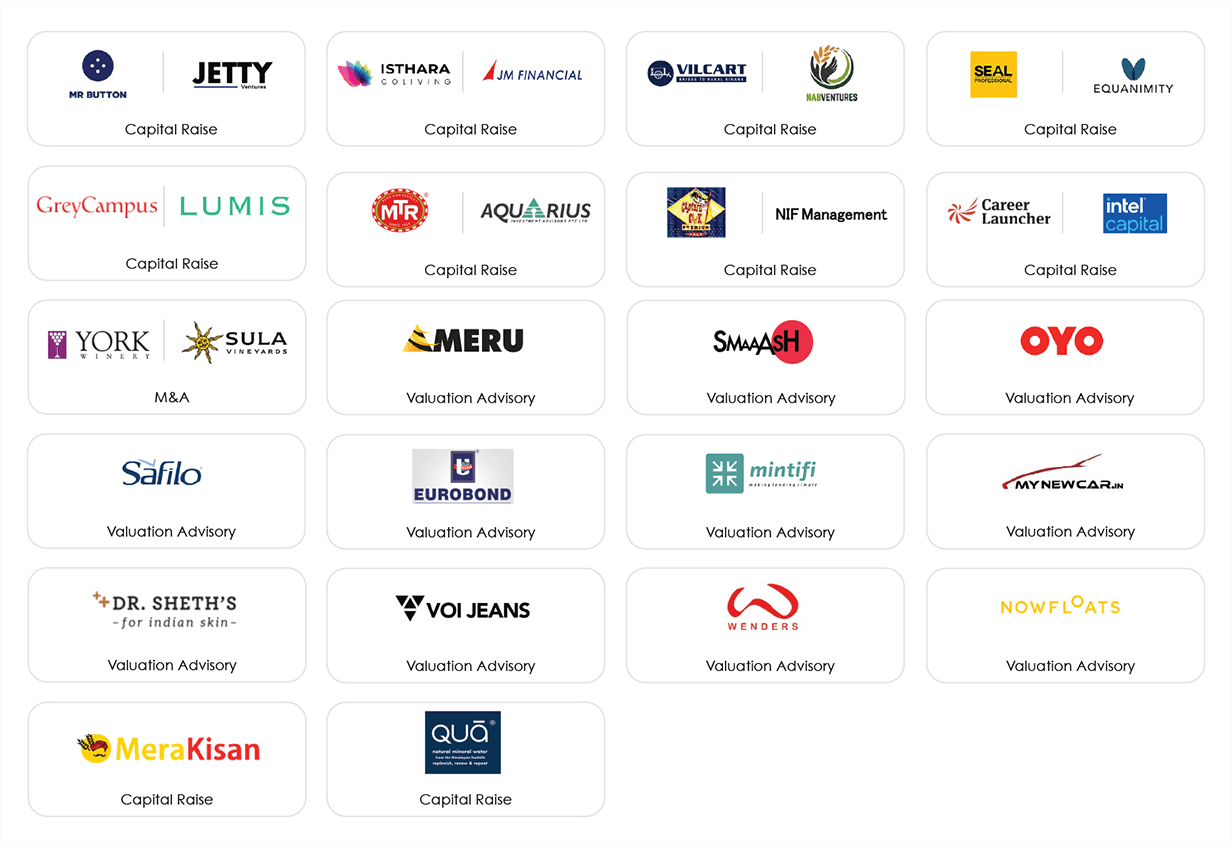

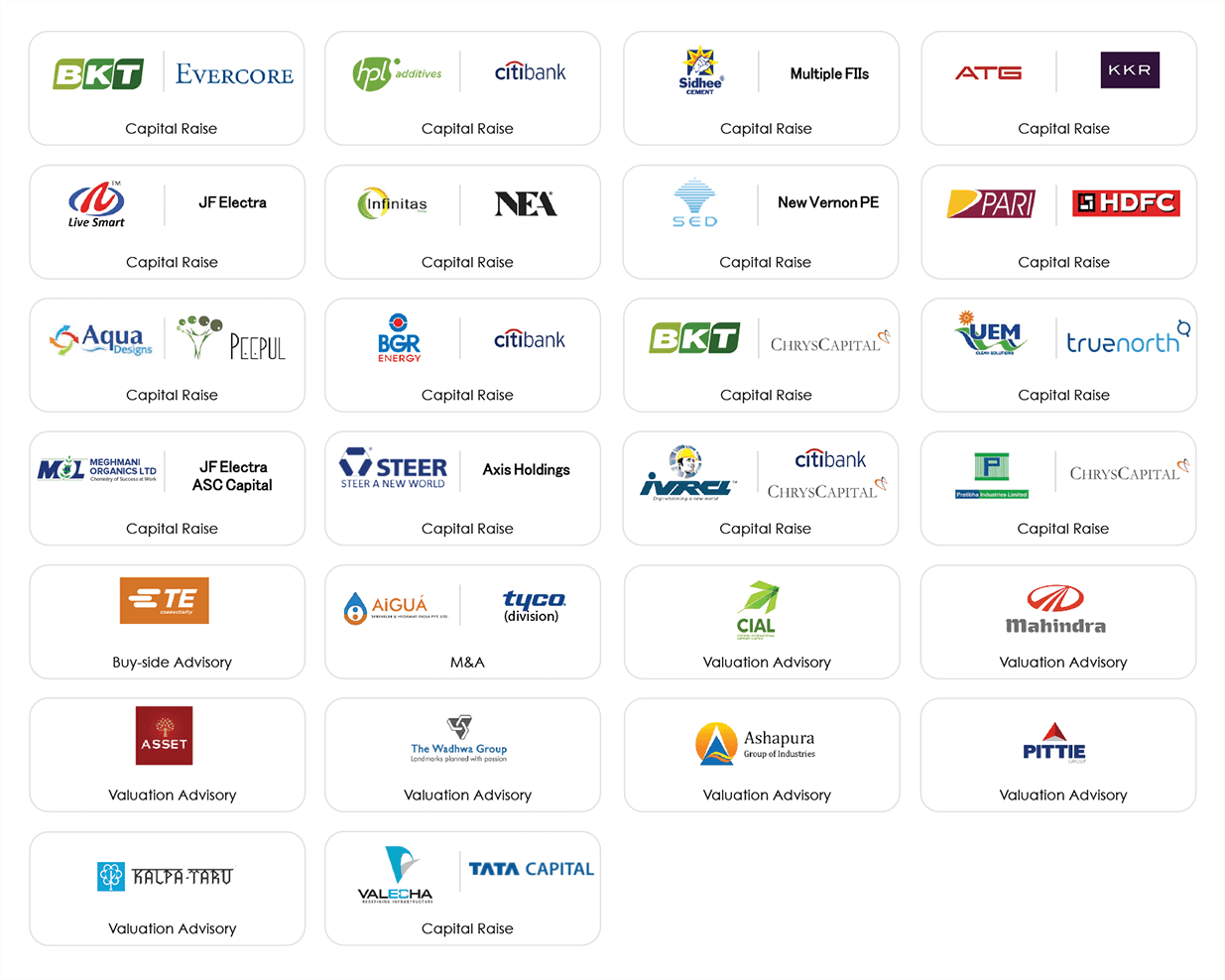

Transactions include deals led by Partners through their careers

Transactions include deals led by Partners through their careers

Transactions include deals led by Partners through their careers

Transactions include deals led by Partners through their careers

Strong Legacy,

Entrepreneurial Energy

A combined team experience of 100+ years in deal making with the energy of a young firm.

Client First

Approach

We take the long view and invest in relationships, not short-term gains. We commit to our clients’ long-term goals.

Rigor in the

Process

Our engagement evaluates plans and questions all assumptions to yield superior advisory outcome and more informed decision-making.

Leverage

our Network

We create multiple possibilities for our clients through a diverse network across investors and corporates

Nitin has about three decades of deal making experience across sectors with a special focus on healthcare & lifesciences. Nitin leads the Pharma, Healthcare and Chemicals/Industrials practice at NRC.

In his earlier avatar, he co-founded Cipher Capital, a mid-market focused private equity and M&A investment bank and later moved to HDFC Bank as Head – Corporate Finance, Investment Banking. He set up Fulcrum Advisors in 2017 that was later integrated into the Corporate Advisory arm of NRC.

Nitin is a management post graduate from IIM Bangalore & a Chemical Engineer from NIT Rourkela.

Nitin Jain

Managing Director

Pratik is a thoroughbred finance professional with 25+ years of rich experience across various facets of corporate finance with special focus on valuations. He founded Lakshya Consulting, a corporate finance advisory firm whose practice was integrated with NRC’s corporate advisory arm. Previously he has worked with reputed Indian & global MNCs such as Zee Telefilms, BDO, EDS (a Fortune 100 company) & ICICI Bank.

In his focus area of valuation, Pratik has worked with clients across industries, and has been involved with complex valuation assignments involving international operations of Indian companies and Indian operations of MNCs.

Pratik is a rank holding CA, a rank holding Cost Accountant, and an MBA in Finance. He has also done advance management programs from IIM Ahmedabad and ISB.

Pratik Singhi

Managing Director

Satyajit has about 18 years of experience in Investment Banking and Management Consulting. He has advised clients in Technology (Both SaaS and Consumer Internet), Digital Commerce, Fintech, Digital Media and Education sectors on fund raising and M&A transactions.

Prior to NRC, he worked at Tower Capital Advisors, a boutique investment bank and before that with Wizarth Advisors, an IT focused boutique M&A advisory firm, which merged with Equirus Capital. He started his career in London with Volensis, a corporate finance advisory boutique focused on M&A and Capital Raising.

Satyajit has a Bachelors in Telecommunication Engineering from PES Institute of Technology, India and a Masters in Digital Signal Processing from Lancaster University, UK.

Satyajit Chakraborty

Director